There are a number of mechanisms available for individuals to save in a tax-efficient manner for their retirement – from employer-sponsored pension plans to government plans, RRSPs (registered retirement savings plan) or TFSAs (tax free savings account). But, for those who earn a higher income and wish to contribute more to their pension savings than they can benefit from under the plans which are subject to annual caps, options can be limited. The insured retirement program is an effective way to bridge the retirement savings gap for such individuals in a cost-effective way.

Individuals who already contribute the maximum allowable amounts to both RRSPs and employer-sponsored pension plans but want to save more for their retirement are ideal candidates for this program.

Individuals at least fifteen years away from retirement so they can accumulate enough funds inside their life insurance policy for collateralization.

Individuals that are comfortable with the concept of borrowing.

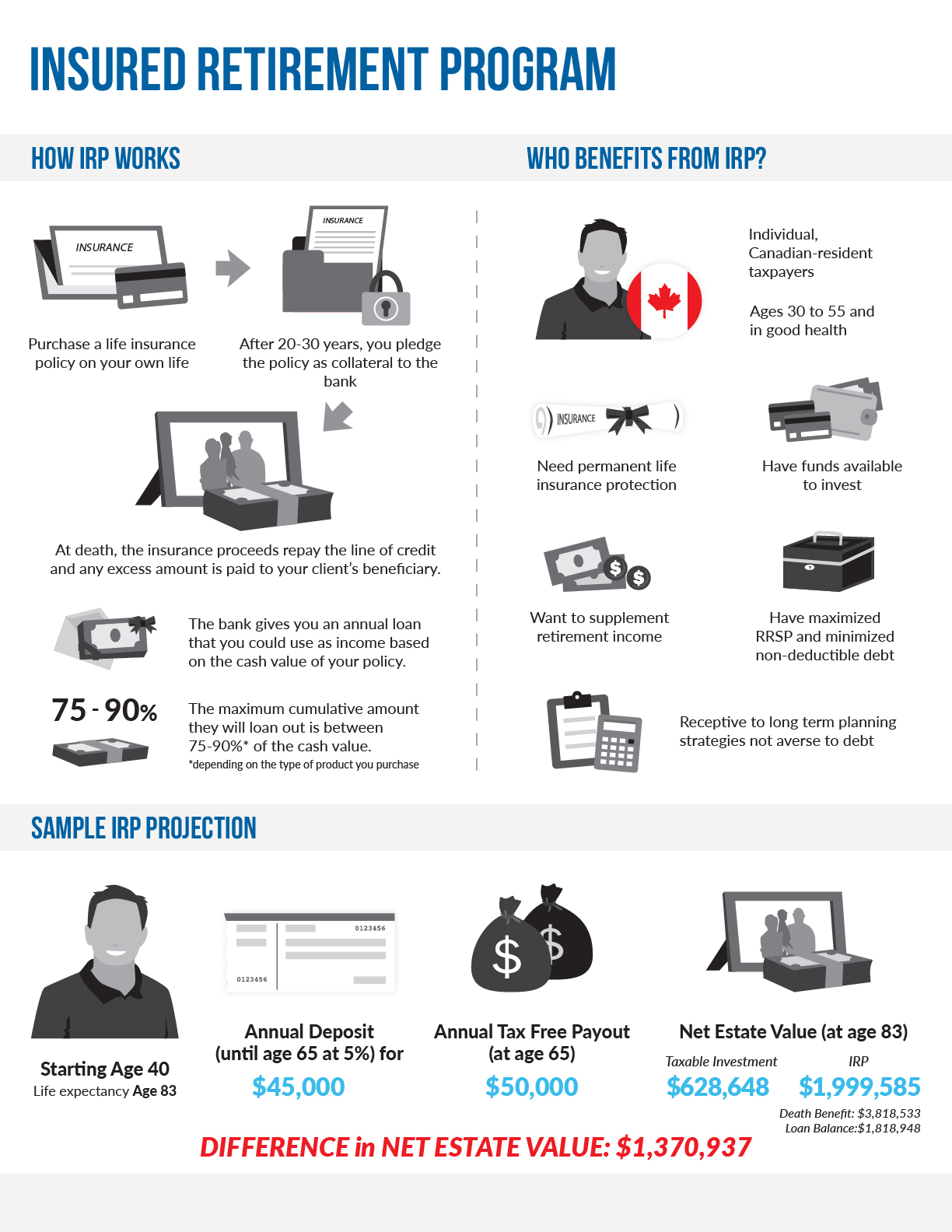

This program works with the concept of collateralization in the following way:

Individual takes out a universal life (or eligible whole life) insurance policy and subsequently makes sizable cash deposits into it. These deposits grow within the policy on a tax-sheltered basis providing that the funds remain in the policy and are within the maximum allowable limit.

Upon the retirement of the policyowner, the funds within the policy may be used as collateral in order to take out a loan.

This loan can provide valuable cash for the retiree, in order to purchase an annuity or to use as income, via a series of short loans.

When the retiree dies, the loan is repaid and the remaining balance can be distributed among their beneficiaries.

As with all investment strategies, there are some risks. Namely, in this case, the fact that the program involves incurring a debt, borrowing funds and interest rate changes means that investors need to be comfortable with the unlikely but possible fact that the bank calls the loan or that changes in tax rules negatively impact them.

The insured retirement program can be smart way for high earners to maximize their retirement income in a tax effective manner. Contact us today to learn more about this opportunity and allow us to work in partnership with you to understand your unique needs and requirements and create a retirement strategy that works for you.

Ong Financial Planning Services Ltd.

John Ong, CFP, CHS, CPCA, CCS

Financial Planner

Tel: (604) 676-1088

Email: ![]()

1275 West 6th Avenue 3rd floor

Vancouver, BC

V6H1A6