Your ability to earn income is your most valuable asset. Disability insurance is designed to protect you from a possible loss of income. What’s the possibility of this happening? Below are some statistics on disabilities occurring at different life stages.

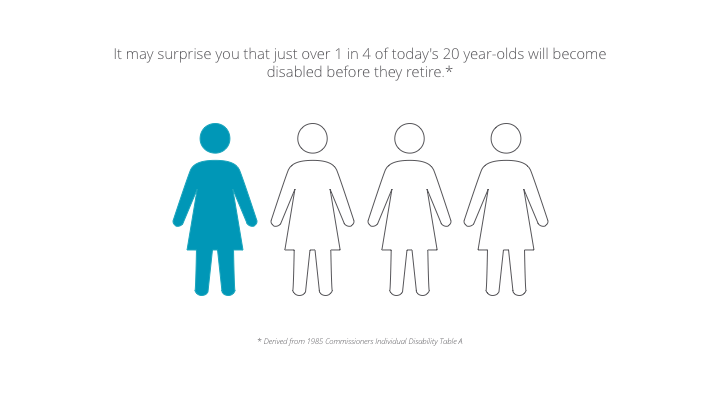

It may surprise you that just over 1 in 4 of today’s 20 year-olds will become disabled before they retire.*

Why should you consider personal disability insurance?

Worker’s Compensation only covers work related accidents.

Unemployment insurance only covers 15 weeks.

Canada Pension Plan: Are you comfortable relying on the government for a benefit that can change?

Group and association coverage can fill a valuable role in long-term disability protection.

However, the benefit may be limited by the definition of disability and coverage amount.

Remember, a custom designed individual disability plan will provide you with guaranteed coverage and guaranteed premiums.

Ong Financial Planning Services Ltd.

John Ong, CFP, CHS, CPCA, CCS

Financial Planner

Tel: (604) 676-1088

Email: ![]()

1275 West 6th Avenue 3rd floor

Vancouver, BC

V6H1A6